File: 1624226559360.png (1.98 MB, 1920x909, 640:303, Republic of Venice.png) ImgOps iqdb

Anyways, having such a big hole in my cv, I guess I'll have to lie my way into a job somehow, but I don't know how feasible this is nowadays.

I don't know if it makes any difference, but I'd like to know specially from people in Europe (more specifically Germany). Thanks in advance.

>>181181

I live here and don't get shit. Maybe it was good before hartz IV.

lol why be ashamed?

I'm 25, never worked… Tell me about volunteering. Every time I think about doing it I just can't bring myself to do it. Spending all that time working, for free, it's my worst nightmare. The idea of working for money is bad enough but I don't know what I'm going to do otherwise.

>>181240

>The idea of working for money is bad enough but I don't know what I'm going to do otherwise.

Not the Anon you replied to, but-

You could consider seasonal work, especially within retail. I am older than you, Anon, and to date the only job I've held was a seasonal job at a department store.

You basically get a three-month contract with whatever employer you land on and work part-time doing whatever small tasks management deems too unimportant for the full-time and part-timers they already have on staff. Even if you hate it, you still get paid at least minimum wage, another item to put on your resume, and a finite end-date for when it's over. If you end up finding the job somewhat tolerable, there's even a slight possibility of a part-time job offer at the end. Seemed more rewarding to me than interning or volunteering ever could be.

Hmm. Well, it can actually be rewarding at times. Guess this is unwizardly to say?! Volunteering with old, or disadvantaged, in the community…

Also as a volunteer most places you can pick and choose your shifts, or what they expect will be less. So pretty much everywhere I started out just doing four hours, or even less sometimes I think, and then only increasing if I wanted to. And on your resume you don't really need to mention how much or often you were actually doing the volunteering, and few will ask. It definitely helped me get a few of my better jobs.

Forgot to say… The four hours was like once a week - per place, so really minimal to start off with, and get a bit used to being around people.

ive never actually tried looking for a job. i do one google search and see all the bullshit forms and hoops they make you go through. nothing about finding a job or working interests me

Or it could crash and you lose everything. If you want to invest do it in stable companies you trust. Make sure to diffirentiate stable and stagnant.

>>181173

Try to find just the simplest possible job in a field you’d like to work. Even If the pay is shit after a year there other companies in the field you want to work in are a hundred more times likely to want to hire you. As for getting that job I think I applied for about 20 jobs.

I was able to get my first job in my late 20s through a temp agency. Been working full-time for several years now.

I started to say that you get used to it, but you really don't. It's always bad. But it becomes a routine eventually.

Forget about jobs. I've stopped looking. I had one and got laid off due to pandemic and I am actually thankful for it because it put pressure on me to find alternative ways of making money.

I currently trade stock options for decent premiums, haven't lost any money, and I actually love this stuff. I will never go job hunting again.

Crypto is too volatile. I trade Put Spread options. I have yet to lose money after a year. My returns have done better than crypto and they are in cash. Because it sell the options, the trades are heavily in my favor, usually around 80-90% probability of profit.

What strategy do you use? The wheel? Do you write naked puts/calls? Credit spread? I myself have been doing some extensive research on options it's fun to see someone else who trade options it's like seeing someone from your home country.

I use Iron Condor on SPY. I keep about a $5 distance away on both sides of the underlying’s current price. So for Friday, the current price is 443. So I’ll do my short legs of the Iron Condor at 438 and 448. It’s not the most profitable thing in the world, but it is a consistent income generator.

If you aren’t sure what an Iron Condor is, it’s a combo Put credit spread and Call credit spread, so 4 legs in total.

Also, SPY does 3 weeklys (like SPX), so I do all three. Most stocks and ETFs only do 1 weekly or they only do monthlys. Which is great because more income on 3 weeklys.

Then I still have to have a job to save enough money to get a significant profit from trading.

>>182917

Thanks friend I'm just reaching the point where I can begin to understand options. If I understand you correctly you're betting that the market goes sideways and you are mining premiums right? Also If I could ask what's your opinion of margin… I have some available that's burning a hole in my pocket.

>weeklys

That is the strategy that I'm leaning towards, I know that statistically I'll usually make money selling calls or puts that have a 30 DTE but selling options with a couple day to expiration does sound both safer and more profitable.

Work at a easy minimum wage job, save up 70% or more of your wages and in a single year you'll have saved 20k-30k$ which is a pretty healthy account to trade with. Start browsing / SMG / on /biz/. Avoid crypto for now as well as forex.

Right now most businesses are desperate for workers so just go to a supermarket or other retail store and ask for a job,they'll likely tell you you have to fill out a application online so do so in advance, keep pestering them till you get the job.

As someone who had to wage slave for 5 years I feel like I have to warn you… You definitely want to get a job quickly and then leave it quickly. Working has made me a much more cynical person, if you are a introvert/quiet person like me it's going to be hell working with a bunch of assholes and interacting with prices of shit entitled customers. You must have the mentality of "uncompromising self-preservation" coworkers bosses and customers alike will try to bully you. You need to view your job as a ATM you are there only for money, if you can make a friend there that's great but don't make yourself vulnerable. If you want to help your coworkers out that can be okay just don't get taken advantage of. Again your coworkers will try to fuck you over, only help someone out after they have thoroughly proven themselves to be kind to you. As far as your employer goes give them the minimum amount of effort required for them to not hassle you. I never got paid extra for working harder than others.

>Hey Anon can you cover my shift?

No.(in your head call them a nigger)

>Hey Anon can you come in on your day off?

No sorry boss (in your head ask them if they can suck your dick)

>Oh that's not the correct way to stack that product wow, how many times do I have to show you?

Oh I'm terribly sorry if it's not the right way how about you do it

for me.Okay? Great. -Make sure you have a unfriendly flat tone of voice when you talk to rude coworkers.

>Let's talk about inane pop culture shit even though you want to browse your phone on your 15 minute break!

Oh boy….

It won't be fun but I believe in you!

Yes, you get less profit. Anywhere from 10% to 20% Return on Risk but it’s a lot safer and consistent. Lately liquidity has been shit on SPY with a lack of volatility so I’ve had to resort to Iron Condors to make my minimum premiums. My go-to is usually a Put Spread. But as I said, liquidity hasn’t been there lately because the S&P 500 has been spiking. I’be been considering moving to the full SPX index because they have daily volumes of 400 million+ as opposed to SPY which is like 20 to 40 million.

But with 3 weeklys you are almost guaranteed to make money. I’ve only had to close a trade early a couple of times out of many dozens.

>>182951

That amount isn't nearly enough to be able to survive from the profits of trading.

Even if I could somehow beat the index (seems unlikely) I'd just be able to take a few % out each year.

Without wageslaving, I'd need to have so much money that taking a few % each year is enough to survive.

The risk is very favorable. I’ve never had a failure/loss. Only a few early closes (still profit). With selling contracts a few days ahead, it’s like 90% in your favor. Deltas are usually like 10 to 20 tops on short legs, plus theta makes it cheap to exit.

I started with a small account. Like maybe 1000$ capital. Then using compounding I built myself up to tens of thousands.

Yeah that's good and I'm trying to save so I can do the same. Your post was good but I just meant that I'd have to work a lot more than a year to be able to stop working permanently.

I don't see how I could do it in less than 10 years. Wouldn't a couple of hundred thousand be required?

Or what kind of annual profits were you counting with?

Ideally, you need $30,000 to SPY or SPX weekly options for a living. That way you put up $10,000 collateral for the spreads and get like say $1000 premium 3 times a week.

You can even do it with $20k saved up. Is that workable? How much you want to make in a year? If $50k than $10k collateral.

If I moved to a cheaper country I could probably get by with 20k per year but I didn't know you were talking about such high profits.

When thinking about my future I've always thought I shouldn't count on more than 10% per year, that's why I've counted on needing hundreds of thousands.

Do you put most of what you make back into investing then?

Yes, I am at the point now where I take $2000 a week out from my premium profits and reinvest the rest for compounding interest.

I do 100 contracts worth of spreads on SPY three times a week. For one trade, I put down $10,000 in collateral, get my $1000 to $1500 premium and when the contracts expire or I close the trade, the $10k collateral gets released and I get my $1000. I do that three times each week. Figure about $100

Collateral needed for each spread contract. Scale up as needed.

Do you sometimes do put spreads and sometimes iron condor depending on what's happening then? Is it just a certain kind of put spread then?

I can Google to learn how they work but how do you figure out which thing to do at what time?

And what's the decision you make when figuring out exactly what the contracts should be?

My standard is a Short Put Spread, also know as a Put Credit Spread. When the volume is low (low volatility, low liquidity), I switch to Iron Condor to get more premium. I try not to go below a premium of $10 per contract.

As far as strike prices, my standard rule is 5 points away from current price. So SPY is around 445 at today's close. So for Monday, I am in for a spread of 440 short, 439 long.

Since the premium was shit due to a lack of volume causing the price to spike, I also added a Call Credit Spread (to make an Iron Condor), which is at 450 short, 451 long.

You have to calculate how much the underlying can move until expiration based on Implied Volatility, but it is usually around +/- 4 to 5. Stay that distance away from current price to be safe.

But if you like math, the calculation is Current Price * Implied Volatility * Square Root(n/365) where "n" is the amount of days to expiration. That will give you 1 standard deviation (68% of all cases) worth of high/low movement.

And make sure to use this before getting into any trade

https://www.optionsprofitcalculator.com/

40% chance of failing? No. Iron Condor is ideal for a stock or ETF which doesn't have high volatility to begin with (like SPY), especially if you aren't going farther out than 3 or 4 days.

It's more likely to fail the farther out you are from expiration. 3 or 4 days? No.

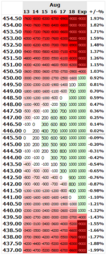

File: 1628897297383.png (85.62 KB, 632x607, 632:607, Capture1.PNG) ImgOps iqdb

Look at these two example Iron Condor spreads.

One is 30 days out. The other is less than a week. Notice how the Iron Condor widens as it gets closer to expiration. This is because of Theta eating away at the option premiums.

The probable price movement on the one a few days out is between +5 and -5 from 445.

The probable price movement on the one 30 days out is on an implied volatility of 15% is +19 - 19.

Would you be a retard for opening an Iron Condor 30 days out? Yes. A few days out? No.

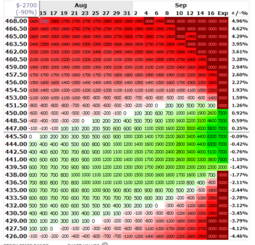

File: 1628924751624.jpg (329.86 KB, 711x1807, 711:1807, Screenshot_20210814-012757….jpg) ImgOps iqdb

But when you do the put spread, don't you need to know if the price will go up and down?

The problem with an Iron Butterfly is that the strategy takes out At-The-Money short positions. This substantially increases your risk of getting assigned, or even early assignment. Ideally you would want your short positions to stay out of the money. Just look at the deltas of the ATM strikes. I guarantee that they are over 30, meaning pretty good chance of finishing ITM

File: 1629031413934.jpg (167.72 KB, 997x2048, 997:2048, Robinhood.jpg) ImgOps iqdb

>>182917

>>182917

I just found out that spy is not cash settled…So if my Put Credit spread has a short leg that expires in the money, with a long leg that expires out of the money. I'd have to buy 100 shares for every put I sold and would still lose the premium on the long leg of my Put Credit Spread. The chances of that happening would be slim if you're only trading within a dollar spread but still, that's kind of spooky.SPX for spreads it is!

Also how does your strategy mitigate risk for middle-sized accounts? For example if you had a $1,000 account I could totally see how a credit spread would be attractive simply because the amount of money you're risking overall isn't that much. If you had a larger $200k account you could set 10% away to aggressively trade with. I currently have a 30k account it took years of work to save making me much more adverse to risk losing it. I could buy a credit spread like pic related but in doing so I risk a substantial portion of my account. So wouldn't it be better to trade the wheel on spy? Because unlike a credit spread your loss is technically impermanent so long as you're bag holding something good. A event like the coronavirus crash/recovery happening again is worrying to me as I'd be boned if I had half my account as collateral on a put or call credit spread.

So how do you protect yourself from IV spikes? Do you aggressively save to increase your account size so your gains make up for the eventual loss? Do you only invest a fraction of your account at a time? But if I did that the amount of premiums I would get will be considerably smaller right?

I greatly appreciate you sharing your knowledge.

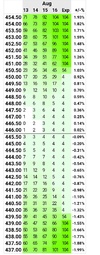

File: 1629032180872.jpg (223.08 KB, 1099x2048, 1099:2048, pic2.jpg) ImgOps iqdb

Here is what I've been doing to mitigate risk:

1. I only use 1/3 of my money at a time for collateral. If I lose money, I don't lose my shirt, so to speak. I would still have two-thirds to keep investing.

2. Be prepared to close the trade early. In fact, it is always a good idea to close a trade before expiration. NEVER let your trades expire ITM. Get out. You can still make profit from a trade gone bad, or you may lose a fraction of your collateral, but that is better than losing the whole thing (at expiration).

3. Black Swans are rare, but you are correct, they DO happen and WILL happen. Keep your eye on the E-mini S&P futures. They can give you a decent idea as to what will happen next trading day. They run from market close to market open, so "over night".

https://www.marketwatch.com/investing/future/sp%20500%20futures?mod=home-page

4. Keep your eye on VIX. That's the CBOE Volatility Index. It'll let you know if IV spikes are coming your way.

https://www.marketwatch.com/investing/index/vix?mod=over_search

Doing The Wheel assumes you let everything expire, whether ITM or OTM. Don't do that. You can still take advantage of Theta without taking on shares of SPY. I simply use the Iron Condor spreads when I'm unsatisfied with the premiums due to low liquidity, which has been recently. My go-to is a Put Spread.

But you are right. I would rather things be settled in cash, so I am strongly considering moving to TD Ameritrade (they have ThinkOrSwim platform) and do SPX or XSP.

XSP is like the same thing as SPY but settled in cash and is taxes much better…

https://www.cboe.com/tradable_products/sp_500/mini_spx_options/?gclid=4cb0b8f8456f1e00ee45d9e15c91b74f&gclsrc=3p.ds&utm_source=bing&utm_medium=cpc&utm_campaign=XSP%20-%20Exact&utm_term=xsp&utm_content=XSP%20-%20General%20-%20Exact

>>182999

I was just playing around with the settings but I used your numbers but in an opposite way to simulate betting on it moving instead of betting on it to stay still

10% per week will make you a billionaire in a few years if it always succeeds

Doing it very many times gives a pretty high risk for losing several times in a row though.

I think I'll try this and see how well it works

If you are going to try it with real money, start small until you get comfortable with it. Otherwise you could play around with paper trading on think or swim.

Ah ok. So it may have been a long iron condor. That would be great for high volatility like Tesla or AMC but the S&P 500 doesn’t move all that much in a few days

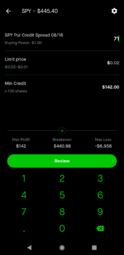

File: 1629128386360.jpeg (57.11 KB, 968x397, 968:397, Web capture_16-8-2021_113….jpeg) ImgOps iqdb

Doing a Box Spread looks like guaranteed free money too. There was a case on R*ddit of someone doing that, bragged about guaranteed free money, then got assigned and lost 2000% lol

It's best to stick to put spreads. Today is a good day for put spreads because sudden IV surge and the S&P is down about 0.40% so more premium money for standard put spreads

File: 1629155640385.png (859.09 KB, 640x640, 1:1, 1627778750927.png) ImgOps iqdb

Thank you my friend you've been very helpful. You have given me some new tools and perspective, part of what makes option trading hard is you not only have to learn the technical side but you must also develop a good trading philosophy.

>Doing The Wheel assumes you let everything expire, whether ITM or OTM. Don't do that.

My understanding of the wheel must be off then, I thought that people actively tried to avoid being assigned by rolling down their Put. I'm still kind of tempted by the idea of the wheel because I like the thought of impermanent loss… but on the other hand if the underlying were to drop 50%, I'd still be mostly screwed especially if it never recovered or took years of selling low value calls off my now low value stock for me to recoup my basis. A 1$ spread on SPY plus the safeguards you talked about makes me much more inclined to Put Credit Spreads now.

>ThinkOrSwim platform

They have a kick-ass user interface I have an unfunded account with them just to make use their charts 4-5 of which I'm proud to say I comprehend.

File: 1629163147976.jpg (80.77 KB, 364x471, 364:471, istockphoto-165598950-1706….jpg) ImgOps iqdb

Glad I could help.

Doing naked puts I would recommend against because the margin required for something like SPY would be the strike price * 100, so like 45,000$

Put Credit Spreads are better because the long put pays 99% of the collateral for you, and you only have to put up the difference between strike prices in cash.

As far as the wheel, I don't actually want SPY shares. That would put my account into negative, which is why I try to close all of my trades before expiration. The Wheel wouldn't work unless you get assigned at some point, at which point you switch to a Covered Call. That's fine with a cheaper stock, but SPY is at $445-ish a share. If I took at 100 put spreads, that would cost me near 4.5 million!!! I don't have that kind of account size. But just the same, we play Theta. It's on our side against people trying to short the market or YOLOing their life's savings away.

And like you, I use ToS charts and metrics because they are simply better than anything out there. And at this point, I would rather pay the CBOE fee and the 65 cents per contract commission to trade XSP. That's the S&P 500 mini, so price is comparable to SPY, but without fear of early assignment and all that.

If you want, I could also share the positions I am looking to take for whatever week.

I want to help my fellow wizards make good wizbux

I'm in a similar situation and that's what I've done. Where I asked for more, I didn't get it. Where I asked for less, I am getting several offers. If you're looking back into it, that would be how I would suggest doing it.

Sure. More like 90-95% probability, but that's as close as your are going to get.

Put Credit Spread with $1 between strike prices on your short and long puts. The difference will need to be a minimum of 10 cents which translates into $10. If you can find that, get 10 put spread contracts, ideally $4 to $6 away from current price.

Short answer is no

Long answer is you can push the odds really far in your favor if you REALLY know exactly what you are doing and have good information to work off.

If you aren't a actual expert I would be careful and keep studying.

you dirty bandits are really lucky that many people are addicted to money, good job on destroying the family unit to make money their only friend in life.

Don’t do calls on SPY. Do puts. Selling Put Spreads is a neutral-to-bullish position. Whether it goes up or down won’t matter if you take a safe enough position. Right now the RSI on SPY is over 90, meaning it is really overpriced. Plus the Fed chair is going to be doing some talking on Thursday-Friday. Expect price decrease any time anything to do with Fed comes out.

In other words, sticking with Puts, you should be fine if you pick a stroke sticking to your 1 standard deviation away strategy.

Take current price * VIX * square root of n/365 where n is days to expiration. That bottom will also have a lot of support and dip buyers will start picking it up around there.

>I want to help my fellow wizards make good wizbux

i would be grateful if you could tell me where or how you learned all this stuff.

Say you were involved in a local computer repair business that you ran yourself or something. Just lie and manufacture anything to get you a job.

File: 1629830675514.gif (974.77 KB, 245x215, 49:43, 4.gif) ImgOps iqdb

>Don’t do calls on SPY. Do puts. Selling Put Spreads is a neutral-to-bullish position. Whether it goes up or down won’t matter if you take a safe enough position. Right now the RSI on SPY is over 90,

I myself have to live with my relatives and I'm 32 and never had a job myself. It's not fun. I've been rejected from SSI thrice over and it's not like I'm employable even if I could stand contributing to a system I can't stand. The only time I've had money was when I donated plasma but they kept rejecting me over either my beats per minute and when not that my blood pressure would be up. Like yin and yang with me. I tried hypertension meds and they don't even work. "Let's try more meds". As if. It's up when it's up and if the meds can't fix what's wrong it's a patch job with bad side effects that costs money.

>>181173

Not that I have any assets but if I did I'd buy and resell. I hate corrupt capitalism myself but it's not like anyone will buy what I make and I'd lose too much money to try to make them buy it, be it a chair or an ocarina or whatever else. If I make a shoe will someone buy it? I don't have money to try anything like that.

>>181205

Indeed I'd be ashamed if I were contributing to the system and it's rules of which are completely backwards and full of people I can't stand to begin with. He might have a gaslight problem happening to him.

>>181254

I'm sure he wants assets. In this world assets are power itself. No options otherwise hardly at all.

>>182808

I think normalfaggots lie but yes it would make you unemployable to have no references even if you did have an education.

I got interested in it a few years ago. Starting from Robinhood, I heard of options before but never saw them before. I saw they had complex metrics like Delta, Gamma, Vega, Theta, Rho, and Implied Volatility. I had no clue so I started researching what these meant on search engines and you tube. One I would recommend seems like a fellow wizard, InTheMoney is his channel (he even mentions his virginity in one video). I started reading about different strategies and played around with OptionsProfitCalculator.com

RSI means Relative Strength Index.

A number over 70 means the stock is overpriced/over bought

A number under 30 means underpriced/under bought

So if something is sitting at 90, you could be pretty sure that sells are coming

All indicators have some reasoning like this. However the issue with trading is that it is a competitive game. If it were that simple then everyone would run bots that make money. But then people run bots that trick those bots by manipulating the order book. and so on…

The system is the highest level of unpredictability

>I just implied that I have a social life but it's okay because I was vague about having a social life so it does not break rule 3 like at all

Socializing at work because it's necessary is one thing, but saying that you do it for pleasure is against the rules here

It’s probability. Most things run smoothly and heat up at certain times almost like clockwork. If you look at dips this year in the S&P 500, you notice most of them have been around the same time every month. There is a reason for that. Most option positions expire then, so the increase in volume means more volatility. The real unpredictability is the news, like events we can’t foresee.

Take last week for example. Some ISIS idiot did a suicide bombing at the Kabul airport. Volatility spiked for a day from the moment the news was reported.

Then there was Friday, where Fed chairman Jerome Powell spoke about “tapering”. Everyone knew what he was going to say so volatility dropped. That was a predictable event.

If you calculate out a position to one standard deviation, you’re fine most of the time.

>Some ISIS idiot did a suicide bombing at the Kabul airport

Ohh noo this very sad:( just send more troops this will help for sure!

I'm working on testing a new strategy. When volume/volatility is low and premiums are crap, it seems best to hedge with Micro E-mini S&P futures (ticker /MES)

That way when volatility is down, you still leveraged exposure, because things tend to go up on slow days to make up for weak premiums.

Then when things pick up, you short the futures contract and go in with Put Credit Spreads on SPY or SPX or XSP

I don't understand what you mean within the context of the previous comments. Predicting volatility doesn't mean you can predict which way it will go and therefore profit.

Increased volatility always means price goes down. A decrease in volatility means price goes up. Always.

Regardless, I can profit in either circumstance by doing Short Put Spreads.

>Increased volatility always means price goes down. A decrease in volatility means price goes up. Always.

lmao you have no idea what you're talking about

Name one time in recent memory when VIX spiked also causing SPY or SPX to spike.

VIX, and by extension volatility, has an inverse affect on the S&P 500. What VIX does, SPX does the opposite.

I get you, in one of the support jobs I've been employed for only a few months, they put me there and almost nobody was willing to help me, the boss had anger issues and the customers were rude as fuck, and they had doctor degrees, the one customer especially didn't shut up for literally 20 minutes, called me incompetent, laughed and mocked me, until I had enough and told her that she should stop being so fucking mean, funnily enough she was so shocked that she completely changed her attitude, it was like when toxic people get called out online, they suddenly act surprised as if they were the victim. I quit soon after, but there have also been comfy support jobs for me, either way you will find out soon enough if it's something you want to handle.

>she

there is your problem bud, dont look for a job in a company with whores you know, thats just stupid.

Just say you did gig work the whole time. uber doordash ect. There is zero penalty for lying to employers.

sorry Anon, im bad at reading. but in the end, you will always end up having trouble when arguing with succubi, if you have to deal with them in your job, ALWAYS be polite, becuze your moneys on the line you know. good luck man!

I quit after basically being pressured to show up even earlier and realizing that this wasn't going to get better. Plus it sucked that my supervisor asked if I was gay my second day of work and even within a week people were starting to treat me like shit.

Being a wizard in normie workland isn't reallly all that fun.

>working 9 AM to 8:30 PM daily

>succubus who would show up to work at 9:30 and leave at 3:00 and I found out I was being assigned her work.

this makes me wonder if turbo kikes (or its managers) are pushing femtardism for the sole purpose of buying holes to pump

[Last 50 Posts]